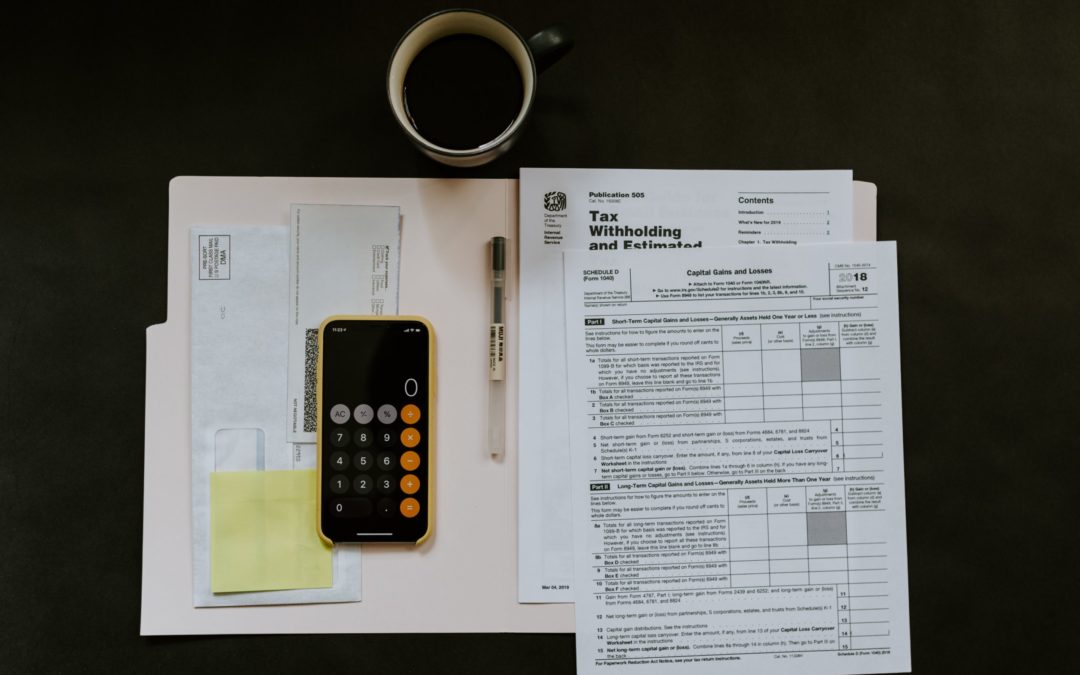

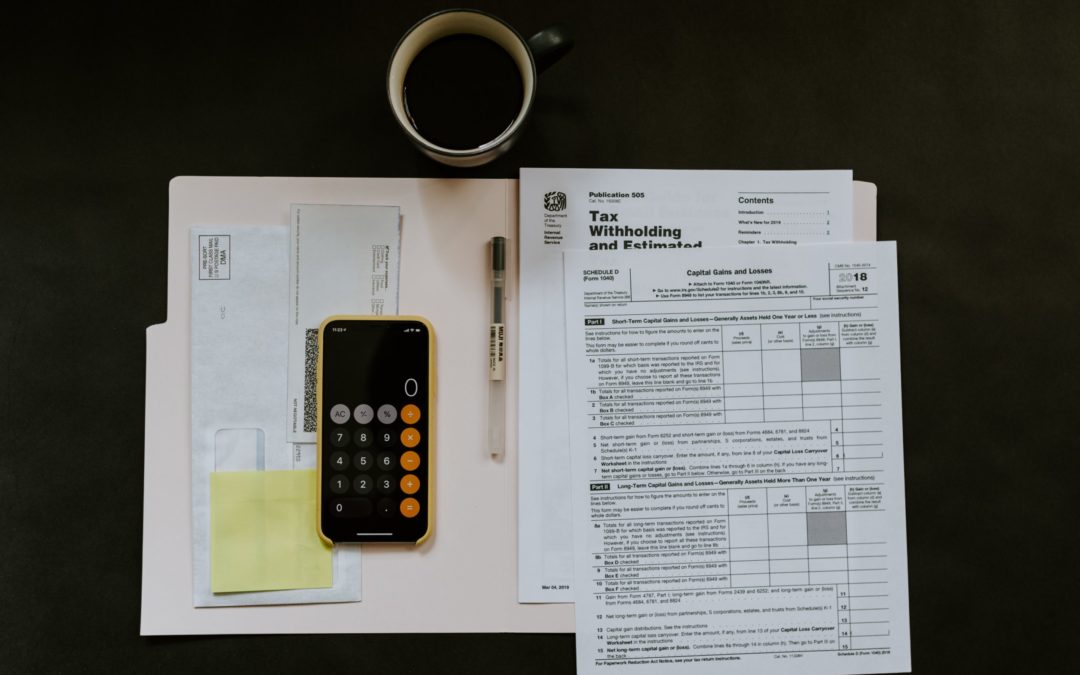

by Mark | Sep 13, 2021 | Tax

One of the most misunderstood accounting concepts in the ecommerce and reselling space involves how to deduct your inventory costs. What is cost of goods sold? How do I calculate it? I get these questions often from resellers. I’ve also frequented forums on eBay,...

by Mark | Jan 1, 2021 | Tax

Dear [insert your name here ???? ], Due to the coronavirus pandemic (COVID-19) and the enactment of legislation to offset the economic burden wrought by COVID-19, as well as a legislation passed at the end of 2019, there is a lot to consider when reviewing year-end...

by Mark | Jun 11, 2020 | Reselling

Not sure if the Paycheck Protection Program (PPP) is right for you? Even as it’s extended from eight weeks to 24, there are a lot of PPP myths floating around. Don’t let these myths stop you from getting the loan your business needs. My partners at Bench have put...

by Mark | Aug 10, 2019 | Reselling, Tax

All the information you need is online. The trouble is sorting through all of the misinformation, including the biggest reseller tax myths, which you will inevitably run into. I talk with reseller business owners almost every day, and I can tell you first hand that...

by Mark | Jun 10, 2019 | Business

If you have ever looked into the various bookkeeping options for your reselling business, you have likely heard about QuickBooks. That’s because it’s the top rated small-business accounting software and is widely used by millions. QuickBooks is made by Intuit, the...